Shut'Em Down

Why did Robinhood stop selling certain stocks last week? It's the same reason why it had to raise a few billion this week

A mini-revolt against the free trading app bringing in the revolution occurred last week after Robinhood (and several other apps) prevented its users from being to able to purchase (or “squander money” on a terrible idea) shares of GameStop and the other big Reddit meme stocks last week.

The more conspiratorial amongst us believed the shutdown may have been caused at the command of Citadel Securities, which is a “market maker” that pays Robinhood a lot of money to execute the orders of RH users — a process called “order flow” — which could have prevented it from losing money from short bets made through its affiliated hedge fund, or to prop up another hedge fund that was in peril because of the work of Reddit users.

But, also, that was not the case. Robinhood has stated that the reason it had to prevent its users buying stocks and options was because of an even more boring part of the “plumbing” that allows the finance industry to flourish known as a clearinghouse. And issues caused by the issues with the clearinghouse forced Robinhood to line up $3.4 billion in very quick financing.

So, what the f just happened?

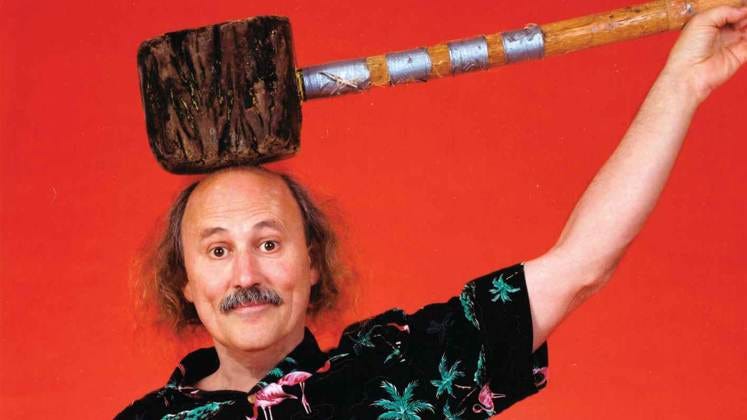

Financial clearinghouses according to legendary prop comic Gallagher

There are a lot of behind-the-scenes things that must happen for you to receive a stock/option/etc. after handing money over to someone via your brokerage (like Robinhood.)

The first thing to keep in mind is that while you may buy a stock and the transaction appears to have occurred really quickly, it actually takes two days for your trade to have an official settlement. And that settlement occurs via something called a clearinghouse.

It’s a very complicated process. But, basically, a clearinghouse ensure that the brokerage buying the stocks on behalf of a client/user has the money to do so (and Robinhood is a brokerage). If the brokerage doesn’t have the money to pay for the transaction, the clearinghouse will foot the bill, which takes away a lot of risk from all parties.

Look all good metaphors used to explain complex financial topics, this one will involve prop comic Gallagher.

Say you are a gigantic Gallagher fan. You will pay him $100 to see him perform live two days later. However, it’s a lot of work on your own to do the legwork to get a person as famous as Gallagher to agree to give you a show. And Gallagher is a busy man and can’t take the risk that you’ll have the money since he’d be out $100 and might have to sell blood.

So, instead, you have found a venue called Clearinghouse to manage the arrangements. Clearinghouse will pay Gallagher no matter if you don’t have the $100 or not. And if Gallagher doesn’t show, or if his evil brother Gallagher 2 shows up instead, Clearinghouse will return your money and tarps used to prevent smashed watermelon stains.

Stock transaction clearinghouses are sorta like that.

Now, keep in mind that the world of finance involves trillions of dollars entangled together. There’s a lot of risk. And a clearinghouse — or, most likely, DTCC, which in the immortal words of Joe Strummer is The Only Clearinghouse That Matters — makes brokerages that use its services have collateral to prove it can indeed pay up. And collateral in this case means “a lot of money.”

But as we said: A lot can happen in two days. And as we saw with GameStop and AMC and etc., the price fluctuations (also known as volatility) were historically insane with hundred dollar swings a day and an incredible amount of demand for those stocks. This volatility increases the risk that Robinhood might not have the funds on to complete transactions for it users. Since it’s now more risky, the DTCC increased the amount of money Robinhood had to have on hand to $3 billion, according to what its CEO told (ugh) Elon Musk who, of course, found a way to get roped into all of this.

Also: Robinhood also lends money to its users so they can buy stocks on “margin.” Buying stocks and options via margin is a tactic touted by Robinhood users on YouTube, which is a wormhole you do not want to go down. (NOTE: A highlight reel of wrestling legend Sabu is a YouTube wormhole you do want to go down.) But giving its users money means Robinhood has less cash on hand to do things like afford the $3 billion amount it needed to deposit with the clearinghouse.

So, the DTCC and Robinhood agreed to a deal. Robinhood agreed to not sell GameStock and the other Reddit stocks. The DTCC knocked down its deposit cost from $3 billion to a mere $700 million. That’s why Robinhood Shut’em Down.

Not coincidentally, Robinhood also raised $3.4 billion from its investors this week as a way to afford the DTCC’s demands so it can once again start allow you to buy shares of a video game store mostly located at shopping malls filled with roaming packs of wild dogs.